Term life insurance: how does it work?

The least complex form of life insurance is called a term. A term life insurance policy provides coverage for a set period (e.g., a term you choose) for whatever benefit amount you select. When that period is over, usually 10-30 years, so is the coverage

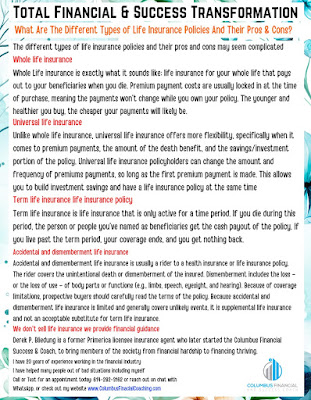

Whole life cash values are guaranteed

Has

a guaranteed premium, the whole life also

provides guaranteed

cash value. As these values build throughout the policy, a loan or

withdrawal may be taken to cover future premiums, meaning your whole

life policy could even become a self-financing asset

Universal life cash values and premiums can fluctuate

In a universal life insurance policy, the cash value growth depends on the current interest rates associated with the specific type of policy. Universal life policies will all see different growth patterns. How much premium you pay into the policy and how much you tap into the cash value will also influence overall growth.

We don't sell life insurance we provide financial guidance

Derek P. Bliedung is a former Primerica licensee insurance agent who later started the Columbus Financial Success & Coach, to bring members of the society from financial hardship to financing thriving.

- Life insurance:Life insurance is payable on the demise of the insured and it can provide the insured’s spouse, children, and dependents funds crucial for helping them maintain the standards of living, could help in repaying the debts, and could also help in funding the education costs of children. The amount you need depends on your financial situation. A life insurance plan is also a tax-saving tool. The policy proceeds that you receive from the life insurance company is also exempt from tax.

Call or Text for an appointment today: 614-282-3162 or reach out on chat with WhatsApp. Columbus Financial & Success Coach

- Auto insurance:Auto insurance protects you from the damage to the considerable investment in a vehicle from liability for the damage and also injury sustained by you or others driving your car. It could also help in covering the expenses you or others in the vehicle might incur due to an accident with the uninsured motorist. Auto insurance is crucial for people owning a car. Most of the time, you’re required to have auto insurance before you could register your vehicle.

- Medical insurance:If you’re insured against medical emergencies and critical illness, you’re staying in a valuable position. Your medical insurance policy could reimburse all medical expenses during your hospitalization. You just need to furnish the required documents which prove that you were under medical supervision. In case you require a cashless policy, the insurer would directly pay the medical bills to the hospitals.Concision

Call or text today for appointment 614-282-3162 or chat with us on WhatsApp.

If you like this article, please check our other articles as well

Questions and Answers (Q&A) about financial coach & financial related updated 2022 Click here

The Art of Making Money Introductory: Different way to make extra income made simple

The Strategies from the Genus’ of Investing: Warren Buffett & Others (2021) Go Here

.png)

.png)

.png)

.png)

2 Comments

Amazing Post, If you are facing problem in Mass Communication Assignment Help , then you can contact BookMyEssay to take experts help. Our company assure you that with the help of our writers you will achieve A+ grades in your subject.

ReplyDeleteThank you kindly for sharing. Your post was truly beneficial. Abogados

ReplyDelete