Questions and Answers (Q&A) about financial coach & financial

What is a financial coach?

A: financial coach helps their clients with the basics of money management: inducing budgeting, reducing household expenses. The best way to reduce debt or get out of debt. They work with clients who may have a bad relationship with money or who have other obstacles keeping them from managing their finances well. Their goal is to help their clients develop healthy money habits that will last.

Why do you need to hire a Financial Coach? (Updated 2022) Click here

What is your main website?

A: Website click hereWhat is a Financial Planner?

A: Financial planners work with individuals and families, to help these clients understand their financial circumstances and how to reach their short-term, mid-term, and long-term financial objectives. What we do is look at your current situation. See any areas in which we can improve and make recommendations.

Call or text today for appointment 614-282-3162 or chat with us on WhatsApp.

What is the Main Difference Between Financial Planner & Financial Coach? (2021) Go here

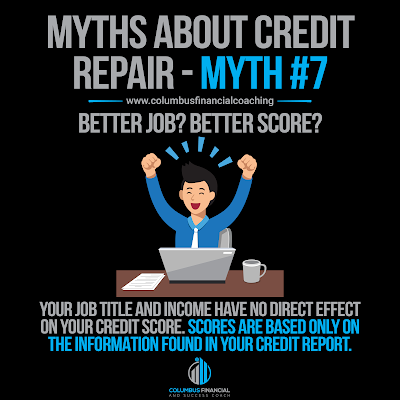

What is credit repair?

A: Credit repair is removing incorrect or inaccurate information from your credit report. In practice, we will improve your credit score. It is illegal to make a false statement in the disputation process. Often clients think it magic build to improve their credit overnight. Often there is little incorrect information that can be legally disputed. This leaves the client to be going through financial coaching, debt management, money management, credit counseling & financial Planning to improve their credit score or fico score.Can credit repair help?

A: At Columbus Financial Coach & Success Coach a credit repair company removes negative items from your credit report & helps improve your credit score or Fico score on your credit report. Making it easier to obtain a mortgage, car loans,

What is money management?

A: Money management like money coaching or financial coaching helps you better manage your money and your financial situation. What we do is look at your current situation. See any areas in which we can be improved and make recommendations. We would look at things like income both incoming and outgoing. We will set up a budget to see what we can do to reduce expenses and place more.

of the income into building savings, paying off debts and improving your overall financial life or your life with money. What type of money Q&A questions would you like us to answer for you? Please leave you replace in the comments.

Why is debt management important?

Assessing Debt Management Performance – Why It Is Important. The analysis and management: In an ideal world we all want zero

debt. But let's be realistic, how many of us have the money to buy a car or a house without a loan from a bank or credit union?

So, we get the loan and pay it off over time, great. We get comfortable with the idea of having debt and we take advantage of the credit cards giving us cash back or travel miles. With the idea, we can pay it over in time. We end up overspending and even might even run up the credit card so much we can't pay even the minimum payment any longer (Your credit card once was great, but now spotty due to high debt and now can't get a zero percent credit card to lower their payment. This is when we receive a call from the client telling me they can't pay their bills help, help, help! So, I hope this example tells you why it is so important to manage your debt. Debt is an easy way to financial hardship. This is when I do financial coaching see above. I will try to have the client placed into a hardship program to reduce the credit card debt interest and place them on a payment plan (Credit Counseling see below).

What is credit counseling?

A: A credit counselor helps a client with debt management and paying off credit card debt that will aid with credit repair. Our duties include reviewing revenue for a customer and creating a plan to help them manage or pay off a credit card and otherconsumer debt.

Call or text today for appointment 614-282-3162 or chat with us on WhatsApp.

Do credit counselors hurt your credit?

A: Participating in credit counseling does not affect credit scores directly. However a comment may be added to the accounts in your credit report that is being repaid through a credit counseling program or debt management plan. So, lenders may see that fact. However, that comment won't affect credit scores.

Is credit counseling a good idea?

A: Credit counseling can be a good resource for those who would like assistance with their credit and financial plans.

What is a money coach?

A: A money coach like a financial coach helps you better manage your money or your financial situation. What we do is look at your current situation. See any areas in which we can be improved and make recommendations. We would look at things like income.

Q: Do I need a financial advisor, financial coach, or financial planner?

A: Put simply, a financial advisor refers to anyone who helps clients manage their money. A financial coach helps one with money issues but also helps one deal with the stress of the hardship of a financial crisis. A financial planner may also have certain areas of expertise, such as investment planning, retirement planning, or education funding planning.

Call or text today for an appointment 614-282-3162 or chat with us on WhatsApp.

What is Transnational Financial Life Coach or Success Coach?

A: Once we have all the financial issues under control. (Financial coaching, money management money coaching, debt management,

credit counseling, & credit repair). This is where we start looking at you as a whole person: Body, mind, and soul. This is a total transformation of what we at the "3 pillars of success" at Columbus Financial Coach & Success Coach. By working on each pillar physical, mental/emotional, and spiritual. This affects improving your overall performance. Even if you work at a dead-end job. You will improve your performance and attitude interns give your better raises in pay and opens you up to move up in the company. Now on the spiritual side: Zig Zeaglar stated people that attended church regularly was able to make $5000 over than the average person in salary. Now, what if we help you connect to the spiritual side (enlightenment, higher vibrational frequencies, higher state conscience). Your spiritual advisors (Angels,

Creditor, Supreme Spirit or God) guide you in life. How much can you make if they guided you to success? Unlimited! This is not a new-age sales pitch. Humans can and are having communications with the spiritual universe, and many others are doing it, why not you?

How much should I pay for coaching?

A: Our prices start at $75 a half-hour & $150 for an hour. We can have payment plans or other agreements for clients in hardship. But Coaching generally ranged from $100 to $300 per hour.

Check out Our Services: Columbus Financial & Success updated 2022) click here

Call or text today for appointment 614-282-3162 or chat with us on WhatsApp.

Can I do financial services myself; Do I need to have a financial coach?

A: No, you can do it yourself. But the advantage of hiring someone is that you will not have to spend hours researching how to make this financial progress. And may avoid many of the pitfalls that an expert can help you avoid.

Where Can I Get Free Financial Planning? (Update 2022) Click Here for more information

In what situation does the client come to you for financial coaching & financial services?

A: In most cases, clients come to me when there is financial pain or over their head in debt, going through a divorce or other financial hardship.

What are your hours of operations?

A: 9:00 am to 6:00 pm Friday to Tuesday. But work from appointments for any of our services.

Is there any situation where financial coaching can't help the client?

A: There are times where clients need overnight or short-term rescuing. Often our services need time to work and blossom. We can't offer instant results. In these cases, I recommend looking at our law of attraction service or manifesting services. I personally can't perform miracles but God, Spirit & Universe can.

What is a financial coach?

A: financial coach helps their clients with the basics of money management: inducing budgeting, and reducing household expenses.

The best way to reduce debt or get out of debt. They work with clients who may have a bad relationship with money or who have other obstacles keeping them from managing their finances well. Their goal is to help their clients develop healthy money habits that will last.

What is a Financial Planner?

Call or text today for appointment 614-282-3162 or chat with us on WhatsApp.

A: Financial planners work with individuals, families, to help these clients understand their financial circumstances and how to reach their short-term, mid-term and long-term financial objectives. What we do is look at your current situation. See any areas in which we can be improved and make recommendations. We would look at things like income both incoming and outgoing. To see what we can do to reduce expenses and place more of the income into paying off debts. in some cases, adding insurance products such as short- and long-term disability, life insurance, etc. We make recommendations on investing for the short, mid and long term, including retirement. Sometimes we make recommendations that the client feels is too passive or aggressive and by working with the client with adjusting our plan to make it a better fit.

What is credit repair?

A: Credit repair is removing incorrect or inaccurate information from your credit report. In practice, we will improve your credit score. It is illegal to make a false statement in the disputation process. Often clients think it magic build to improve their credit overnight. Often there is little incorrect information that can be legally disputed. This leaves the client to be going through financial coaching, debt management, money management, credit counseling & financial Planning to improve their credit score or fico score.

How to Fix my Credit & Improve Credit Fico Score? (Updated 2022) Click Here

Can credit repair help?

A: At Columbus Financial Coach & Success Coach a credit repair company removes negative items from your credit report &

helps improve your credit score or Fico score on your credit report. Making it easier to obtain a mortgage, car loans, credit cards or insurance. No credit repair company can guarantee that a bad score will be improved.

What is money management?

A: Money management like money coaching or financial coaching helps you better manage your money or your financial situation. What we do is look at your current situation. See any areas in which we can be improved and make recommendations. We would look at things like income both incoming and outgoing. We will set up a budget to see what we can to reduce expensively and place more of the income into building savings, paying off debts and improving your overall financial life or your life with money.

Call or text today for appointment 614-282-3162 or chat with us on WhatsApp.

Why is debt management important?

Assessing debt management performance – Why It Is Important. The analysis and management: In an ideal world we all want zero

debt. But let's be realistic, how many we have the money to buy a car or a house without a loan from a bank or credit union?

So, we get the loan and pay it off over time, great. We get comfortable with the idea of having debt and we take advantage of the credit cards giving us cash back or travel miles. With the idea, we

can pay it over in time. We end up overspending and even might even run up the credit card so much we can't pay even the minimum payment any longer (Your credit card once was great, now spotty due to high debt and now can't get a zero percent credit card to lower their payment. This when we receive a call from the client telling me they can't pay their bills help, help, help! So, I hope this example tells you why it is so important to manage your debt. Debt is an easy way to financial hardship. This is when I do financial coaching see above. I will try to have the client placed into a hardship program to reduce the credit card debt interest and place them on a payment plan (Credit Counseling see below).

What is credit counseling?

A: a credit counselor helps a client with debt management and paying off credit card debt that will aid with credit repair. Our duties include reviewing revenue for a customer and creating a plan to help them manage or pay off a credit card and other

consumer debt.

Do credit counselors hurt your credit?

A: Participating in credit counseling does not affect credit scores directly. But a comment may be added to the accounts in your credit report that is being repaid through a credit counseling program or debt management plan. So, lenders may see that fact. However, that comment won't affect credit scores.

Is credit counseling a good idea?

A: Credit counseling can be a good resource for those who would like assistance with their credit and financial plans.

Call or text today for appointment 614-282-3162 or chat with us on WhatsApp.

What is a money coach?

A: Money coach like a financial coach helps you better manage your money or your financial situation. What we do is look at your current situation. See any areas in which we can be improved and make

recommendations. We would look at things like income

both incoming and outgoing. To see what we can to reduce expensively and place more of the income into paying off debts and saving the plan.

Do I need a financial advisor, financial coach or financial planner?

A: Put simply, a financial advisor refers to anyone who helps clients manage their money. A financial coach helps one one with money issues, but also help one deal with the stress of the hardship of a financial crisis. A financial planner may also have certain areas of expertise, such as investment planning, retirement planning or education funding planning. This article may help you:

Financial Life Coaching and Financial Planning has Aided in putting Financial Hardship to a Stop (2021) Click here

What is Transnational Financial Life Coach or Success Coach?

A: Once we have all the financial issues under control. (Financial coaching, money management money coaching, debt management,

credit counseling, & credit repair). This where we start looking at you a whole person: Body, mind, and soul. This is a total transformation what we at the "3 pillars of success" at Columbus Financial Coach & Success Coach. By working on each pillar physical, mental/emotional, and spiritual. This affects improving your overall performance. Even if you work at a dead-end job. You will improve your performance and attitude which interns give your better raises in pay and opens you up to move up in the

company. Now on the spiritual side: Zig Zeaglar stated people that attended church regularly was able to make $5000 over than the average person in salary. Now, what if we help you connect to the spiritual side (enlightenment, higher vibrational frequencies, higher state conscience). Your spiritual advisors (Angels, Creditor, Supreme Spirit or God) guide you in life. How much can you make if they guided you to success? Unlimited! This, not a new-age sales pitch. Humans can and are having communications to the spiritual universe, myself and many others are doing it, why not you?

How much should I pay for coaching?

A: our prices start at a half-hour $75 & $125 for an hour. We have packages coaching. We can have payment plans or other agreements for clients in hardship.

Call or text today for appointment 614-282-3162 or chat with us on WhatsApp.

Can I do financial services myself, do I need to have a financial coach?

A: No, you can do it yourself. But the advantage of hiring someone is that you will not have to spend hours researching how to do this financial progress. And may avoid many of the pitfalls that an expert can help you avoid. Check out this article:

Personal Finance (The Ultimate Quick-Start Guide): The Easiest Beginner’s Guide 2021 Go here

Q: What are some suggestions to help me to start paying off my credit card debt?

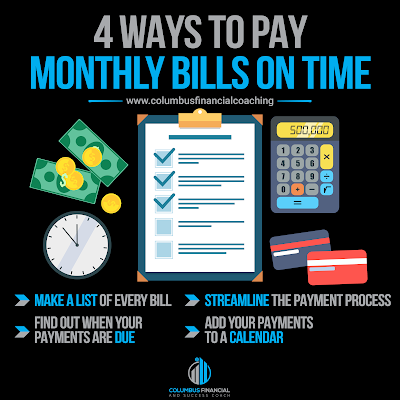

A: I ways advise my clients to start with a budget and look for way to decrease expressive. Next, we will attack the credit card debt. First make sure you have auto payment set up to make sure we are not paying an extra late charge. Pay the highest interest credit card first. With your budget figure how much additional you can pay off your credit card each month. Stop using credit cards and start paying expensive with cash or debt card. Click here for more information

A: financial life coach can give you a more of comprehensive approach to paying off your debts. You are more than just a number and you are more than just your debts. A financial coach can design more of a personalized plan that works for you. Credit counseling often use a standardized approach, that is often interpersonal. Sometimes motivates their clients to seeking to file bankruptcy. And feeling frustrated and a scene of hopelessness. The difference is financial life coach actively listen to your emotional needs and designs a financial plan for you and not your financial institution. For more information

Q: Is there any life hacks or tricks to improve my performance of 401k. 403b or retirement plan?

A: Yes, I trick I tell all my clients is to have an automatic 1% added to their 401K each and every year. Let face it most of us will get at least 1% raise each and every year. If you place that 1% in your 401k, you will never notice the slight difference in your pay. Another idea is to have a balanced found, stock's bonds and cash or cash equivalents. We need to this to take advantage of high and a low market. When the stock market is high, we need to re-balance your 4011k or retirement plan. Selling overpriced stock and placing funds into safer accounts. such as bonds and cash or cash equivalents. Do the same when the stock market is at its low point (after crash or readjustment period). You well sell off safer investment, to pay under valuated stocks. Doing this life hacks will improve your 401k or retirement plan performance. Check out this article:

The Strategies from the Genus’ of Investing: Warren Buffett & Others (2021) Go Here

Q: Is there a way for me to do my own (DIY) credit consulting?

Call or text today for appointment 614-282-3162 or chat with us on WhatsApp.

A: Yes, you don't need a credit consulting, you can do it yourself. This how you do it: You can call your financial institution or collection agency and negotiate a better settlement. You get the best settlement when less lucky for the institution or collection agency to collect the money back. Tends to be older the bad debt less change to collect and better deal you can get. You don't want to stop paying your debt to get a better deal. Don't forget this will greatly hurt your credit score. Click for more information

Q: Can I repair or fix my own credit or FICO score repair?

A: Here is how to repair or fix your own credit score in 6 basic steps

Most people don't check

their insurance rates every few years to make sure they are getting

the best price. (Auto, Home Renters). And you might be paying too

much for your insurance.

Check your credit score, you can get a free report at https://www.annualcreditreport.com/.

Dispute or fix any errors on your credit report. Don't forget you only allowed to dispute legitimate errors by law on your credit report.

Pay your bills on time.

Keep Your Credit Utilization Ratio Below 30% of the credit income ratio.

Don't forget it is important to pay down all debt

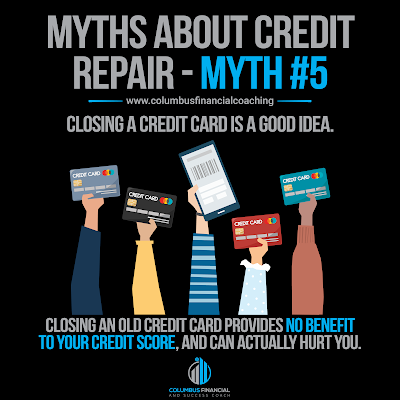

Keep old credit cards open and try to avoid opening new accounts.

https://www.columbusfinancialcoaching.com/2019/05/how-to-repair-your-own-credit-fico-score.html

Q: Do you have any idea to help me save money n these hard times?

A: Most people don't check their insurance rates every few years to make sure they are getting the best price. (Auto, Home Renters). And you might be paying too much for your insurance.

-

Are you paying too much for cell phone service? I had a client telling me that they pay $75 a month for unlimited (Calling, test, & data) for 1 phone. They thought they are getting a bargain. I knew there are many other carriers that were offering many lower-priced plans.

Get rid of your cable box, and get a smart tv or Roku, this allows you to save an additional $7.99 in the same cases from not having to rent a cable box. Often streaming is much cheaper than traditional cable TV.

Change how you shop for food. You can save a lot by shopping at Aldi's or Save-A-Lot, the trick here is the first shop at these stores first. These 2 stores don't sell everything. So, buy the rest of your food products at a regular food store.

Don't buy brand clothes at a full-price retail store. You can go to Marshall's or Burlington and get brand-name clothes and home goods at a fraction of the retail price.

You can buy food and home goods and household goods at Ollie's Bargain Outlets or Big Lots. Here are other stores like these: https://ollies.knoji.com/alternatives/

-

Click here for more information

Q: What is passive income how does this makes you money?

A: Passive income is an investment strategy that uses your money to build an alternative source of income. Most of us work for a living like go to work or own a business. Passive income is where you earn income from investments. Your investments pay you a small amount of income either from profits or dividends. I know it sounds great that you can get your money to work for you. But the reality of this strategy it takes time to build the dividend where it will be even worthwhile.

You can earn passive income from

stocks, mutual funds, EFT. For most of us, real estate would be the

most practical passive income. As long as you can place a 20% down

payment for a house or apartment building. You can have a mortgage

and still collect a passive income from rent. Click here

Q: I am 32 years old and have 2 kids my wife is buggy me to take out a life insurance policy. I am not planning to die any time soon what should I do?

A: I am glad that you are not planning to die! The true fact we just don't know when our time is up. Just look how many people did not think they would get covid-19. I am a former Primaerica insurance agent and currently Transnational Financial Life Coach & Holistic Financial Planner, Yes, I think you wife is right you should get life insurance. The question is what is your goals with life insurance? If you are looking for what I like to think as “gap insurance” if you would pass before you retire, then a term life insurance would be a good choice for you. Life insurance is to provide for you and your family when you are no longer here to earn an income. If you are looking for life insurance that pay out a death benefit when you pass, does matter at what age. The benefits if you looking to give inheritance, then universal life or whole life would be a good choice for you.Go Url

Call or text today for appointment 614-282-3162 or chat with us on WhatsApp.

Q: What are some life hacks to help me get ahead in life?

A: We are all born with three bodies a physical body, mind and soul:

we must take care of our physical body get rest & relaxation

We need enough sleep at night

We need eat health food which include non-gmo, organic, and not processed foods.

We need to take multi vitamins and minerals, fish oils, probiotics this is if you are in good health.

How do we improve your mental & emotional to improve you?

Meditation is a starting point to lower stresses and open your mind to new opportunities

Law of attraction (the secret) It will help you think more positively, learn to give gradituted, reprograms your sub-conscience, and how to manifest to you what you want. By changing how we think can have a impact on our outcomes.

Spiritual connection

Has a spiritual based person we believe we have been able to connect to the spiritual universe. And we know that God is real, not because we are told. We know because we have experienced.

Learn to become a Reiki master or another type of energy healer

Learn psychic development, if you are guided by a higher power, it easier to make the correct choices to get ahead in life. You can go to meetup.com to see if there are any local teachers in your area

You can learn kabbalah another very power way to connect to the universe this should be done in the order I have given. You can get a book from Sliver Raven Wolf “Angel Magik”. Learn more click here

Q) How to save on high fuel (Gas) cost?

A) Take public transformation (if you can)

Carpool (if you can)

make sure your tires are correctly inflated

Tune up and maintain your car or truck

Lucas Fuel Treatment will help improve miles per gallon and overall performance.

Lucas Oil Stabilizer will help improve miles per gallon and overall performance.

K & N air filters is cotton filter is will last for the life of the car or truck and can be reused by cleaning it. I can help allow more flow of air to the engine to allow the car not to rev much less. In turn saves gas and improves performance over paper filters. Press here to go URL

Q: Is there any way for me to break away from the rat race?

A: You first have to make yourself a better person then you are now!

Improve yourself physically, mental & emotionally, and spiritually

You can do more an get more out of life once you are better then lost people.

Next do a financial make over and start your own business or start a part time gig.

You don't have to reinvent the wheel the program has already been carefully thought out and tested to improve the the performance of the individual.Go to URL Click Here

Call or text today for appointment 614-282-3162 or chat with us on WhatsApp.

Q: What is the fastest way to get my credit score up?

If you have the money or can get a loan from someone the grid. Like a friend or family member to pay down debt.

Q: How do I raise my credit score from 500 to 700 in a year?

Q: How do I raise my credit score from 500 to 700 in a year?

A: If you have any bad credit that has not been addressed still in collectors make payments agreements to pay the bad debts.

Q: How do you pull your own credit report?

A: It will take a few years to go from there 500 to 800 credit score. You have to keep your debt ratios low, pay bills on time. Keep checking your credit report for any errors at least once a year. As your credit improves keep lower your interest rate. As you improve credit worthiness you will be entitled to lower interest rates.

How do you get a free credit report?

A If you are looking for free credit reports here are a list of some free websites where you can download them for free.

https://www.annualcreditreport.com/

https://www.creditkarma.com/free-credit-report

https://www.creditsesame.com/free-credit-score

.png)

.png)

.png)

0 Comments