When HO-HO Turns into Oh No No!: Dealing with post-Christmas credit card debt

Credit card debt financial coach, how to deal with credit card debt? Debt credit counseling services in Columbus Dayton Springfield Ohio credit card Credit counseling Debt issues, How to deal with debt?

Article updated 08-16-2023

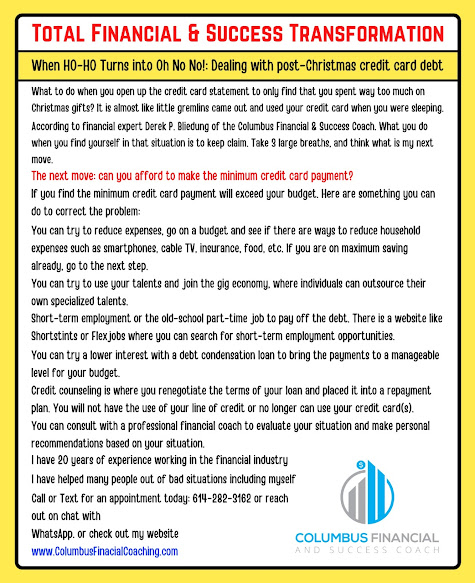

What to do when you open up the credit card statement to only find that you spent way too much on Christmas gifts? It is almost like little gremlins came out and used your credit card when you were sleeping. According to financial expert Derek P. Bliedung of the Columbus Financial & Success Coach. What you do when you find yourself in that situation is to keep claim. Take 3 large breaths and think about what my next move is.

The next move, Can you afford to make the minimum credit card payment?

If you find the minimum credit card payment will exceed your budget. Here is something you can do to correct the problem: Share this article on your favorite social media platform.

- You can try to reduce expenses, by going on a budget and see if there are ways to reduce household expenses such as smartphones, cable TV, insurance, food, etc. If you are on maximum saving already, go to the next step.

- You can try to use your talents and join the gig economy, where individuals can outsource their own specialized talents.

- Short-term employment or the old-school part-time job to pay off the debt. There is a website like Short Stints or Flexjobs where you can search for short-term employment opportunities.

- You can try a lower interest with a debt condensation loan to bring the payments to a manageable level for your budget.

- Credit counseling is where you renegotiate the terms of your loan and place it into a repayment plan. You will not have the use of your line of credit or no longer use your credit card(s).

- You can consult with a professional financial coach to evaluate your situation and make personal recommendations based on your situation. Tell us what steps are you going to take to pay back your Christmas debt?

Call or text today for an appointment or Free 15-minute consultation at 614-282-3162 or chat over WhatsApp.

Check out our other articles!

TheArt of Making Money Introductory: Different ways to make extra income made simpleQuestions and Answers (Q&A) about financial coach & financial-related updated 2023

Personal Finance (The Ultimate Quick-Start Guide): The Easiest Beginner’s Guide 2023

.png)

.png)

.png)

0 Comments