How Does "Credit Counseling" Keep Credit Card Debts at Bay

Summary:

Does "Credit Counseling" keep Credit Card Debts at Bay?

- What should you do if you get into “Credit Card Trouble”?

- Can't pay your minimum payment or get stuck with a high interest rate?

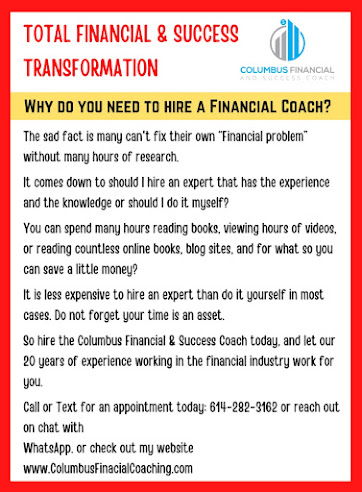

I am the Columbus Financial & Success coach: I know I can offer you a better solution than the above

- I have 20 years of experience working in the financial industry

- I have helped many people out of bad situations including myself

Call

or Text for an appointment today: 614-282-3162 or reach out on chat

with WhatsApp.

Or check out my website click here

Credit Counseling:

Credit counselors are trained to offer

advice on debt management, budgeting, and consumer credit. Through

one-on-one counseling, workshops, and educational materials, they can

tailor a plan to your situation. During Consumer credit counseling near me, your

income, assets, and debt are analyzed to determine the best way to

address financial issues.

Credit counselors are trained to offer

advice on debt management, budgeting, and consumer credit. Through

one-on-one counseling, workshops, and educational materials, they can

tailor a plan to your situation. During Consumer credit counseling near me, your

income, assets, and debt are analyzed to determine the best way to

address financial issues.

Columbus Financial intro:

Having trouble paying your bills? Getting dunning notices from creditors?

Are your accounts being turned over to debt collectors? Are you worried about losing your home or your car? You’re not alone. Many people face a financial crisis at some point in their lives.

Whether the crisis is caused by personal or family illness, the loss of a job, or overspending, it can seem overwhelming. But often, it can be overcome. Your financial situation doesn’t have to go from bad to worse.

A dedicated financial plan will address your monthly interest payments, by putting them into your budget, you need not worry because Columbus Financial & Success Coach is always there to solve your financial hardships and make your life a better and more successful one. If you like this article share it on Twitter.

Call or Text for an appointment today: 614-282-3162 or reach out on chat with WhatsApp.

Financial planning:

Financial planning will give you a wide perspective to live a better financial lifestyle and will fine-tune your habit of effectively managing your budget on a regular basis. So, it is your turn to start your financial planning process now and experience the development of your financial IQ steadily which will, in turn, result in a better Credit Counseling financial outcome. Changing your mindset is the key to moving forward and making progress, Life coaching enhances your mental and physical health.

Everyone deals with a certain amount of stress in their lives, but if they are able to identify those sources of stress, understand what their challenges are, and develop a plan; they can truly lead to an amazing life.

Financial Life Coach:

Columbus Financial & Success Coach will help you become a good resource manager and being a good money manager allows you to accumulate savings. This gives you the security of knowing that you have the resources to deal with unexpected expenses – such things as the car breaking down, your dog destroying your new sofa while you were at work or your boss politely suggesting you should seek employment elsewhere. If you reviewed your expenditures for an entire year, you would see that unexpected expenses inevitably occur. Having savings available means you don’t have to use credit cards to pay for emergencies.

Call or Text for an appointment today: 614-282-3162 or reach out on chat with WhatsApp. Or, take a free 15-minute consultation

From time to time, you all encounter opportunities to make more money or have an interesting experience. A friend may alert you to an investment opportunity, or you may find a terrific deal on a once-in-a-lifetime vacation. It’s frustrating to not have the cash available to take advantage of these opportunities. People who have been successful at managing their money get to go to exciting events like the Master's Golf Tournament, while those who have mismanaged their money stay home and play miniature golf with their somewhat annoying relatives. What steps are you going to do to improve your finances? Add your comments in the section.

Conclusion:

As your income grow, your financial planning will not just involve budgeting so that all the expenses are covered each month, but also determining how to invest the surplus that accumulates above what you spend. Becoming knowledgeable about investment vehicles such as stocks and mutual funds can allow you to earn more on your investment funds than you could by leaving them in a savings account at the bank. Bear in mind that dog tracks or offshore casinos are not generally recognized as sound investment vehicles. The great thing about having investments is that while you are at work earning money, your investments are also working for you.

Call or text today for appointment 614-282-3162 or chat with us on WhatsApp.

If you like this article please check our other articles as well

5 Reasons Why Whole Life and Universal Life Is Not the Best Choice for Every Situation (2022) Go here

WhereCan I Get Free Financial Planning? (Update 2023)

How to get Affordable or "Free Financial Advice"? (Update 2023)

2 Comments

Hello mates, hoow is the whole thing,and whgat you wish for to say on the topic of this paragraph, in my view

ReplyDeleteits in fact remarkable for me.

Got some wonderful knowledge from this post. I got some great information from the article you have published in this post. Keep Posting. minnesota debt settlement law

ReplyDelete